What’s the difference between an independent contractor and an employee? And does it really matter? It turns out it really does! Getting misclassified could mean paying almost double in taxes and losing benefits you’re entitled to, including Social Security and unemployment compensation.

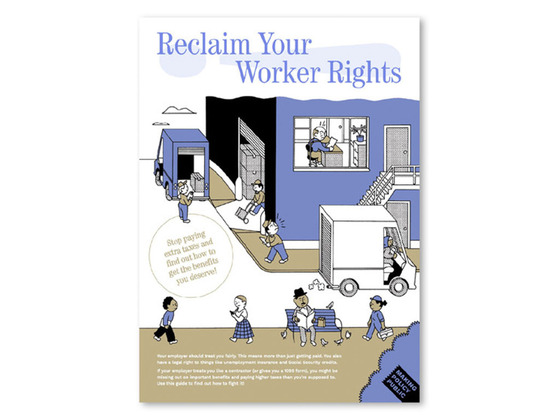

To help workers understand how to avoid misclassification, Philadelphia Legal Assistance’s Taxpayer Support Clinic collaborated with CUP and designers Mike Tully and Peter Gamlen to create Reclaim Your Worker Rights! The guide breaks down different tax forms for employees and independent contractors and explains how to avoid misclassification. It folds out into a poster that shows workers how to fight back if they’ve been misclassified, and how to get support to claim the benefits they deserve.

Philadelphia Legal Assistance launched the guide at a panel they hosted with other legal advocates to explain misclassification and its tax consequences as well as how it intersects with Social Security, unemployment compensation, wage theft, and other labor violations. They are distributing the poster to thousands of low-income workers locally through their own clients and at outreach events and nationally through other Volunteer Income Tax Assistance (VITA) sites, other social service and legal assistance providers, and their network of Low Income Taxpayer Clinics.