In The Field Of Taxes

In The Field Of Taxes

Navigating the U.S. tax system is confusing for anyone. But when you’re a migrant farmworker, filing taxes can be even more confusing. Most migrant farmworkers are immigrants, low-income, and unfamiliar with U.S. tax policies. A majority of them are monolingual Spanish speakers with limited literacy, and live in rural areas with few culturally-competent social services. This makes farmworkers vulnerable to dishonest or untrained tax preparers. As workers move from farm to farm, getting all of their tax documents together and ready for tax filing season is no easy task. By failing to file taxes, migrant farmworkers may lose important refunds, risk having their wages seized by the IRS, and jeopardize immigration opportunities for themselves and their family members.

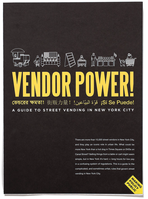

CUP teamed up with the Pennsylvania Farmworker Project, designer Andrew Sloat, and illustrator Michela Buttignol to create In The Field Of Taxes, a English language version of the original fold-out poster. The illustrated poster guides migrant farmworkers–regardless of immigration status–through the tax filing process. By visually highlighting the benefits of filing, the risks of not filing, where and when to seek help, and all of the documents needed along the way, the guide will help farmworkers file for taxes with or without a preparer, and access the important benefits of filing.

- 8″ × 11″ color pamphlet; unfolds to 22″ × 32″ poster